The pandemic that sends the world economy on its knees has also consequently affected the OFWs worldwide. As of this writing, there are about 280,000 OFWs affected by the pandemic. This is based on DOLE’s data on the number of those who have availed of the cash aid given to those displaced land and sea-based OFWs. It means not counting those who in one way or another have failed or did not avail of the said cash aid. This may not have the exact number but the downsizing of the economy naturally resulted in many workers, locally or abroad lost their jobs.

Whatever is the cause of your coming home and repatriation, you bring home with you, and I really hope you do, your end-of-service pay. Literally, it is the money withheld from you by your employer and later paid at the end of your service at the company. Or your take home pay after working abroad. Some companies have included it in their monthly package so that by the termination of your contract, there is no more EOS pay, but you are expected to have saved or invested some of your earnings for times like this-termination of contract.

This is the one thing you should not do with it-lend it to your friends or relatives. For emphasis, do not lend it to your friends or relatives.

It’s inevitable. Friends or relatives will come to you to borrow money. You just came from abroad, you have it. There is no denying it.

But be very cautious.

Not even your well-meaning friends and relatives will save you when the time comes that you need money. Remember that you are jobless now, at least for the time being. You don’t know when you’re going to create your next source of income, especially in this pandemic-stricken world. This is a reason enough not to part with your hard-earned moolah.

If that is not convincing enough to your would-be borrower to understand your situation, here’s what you have to endure.

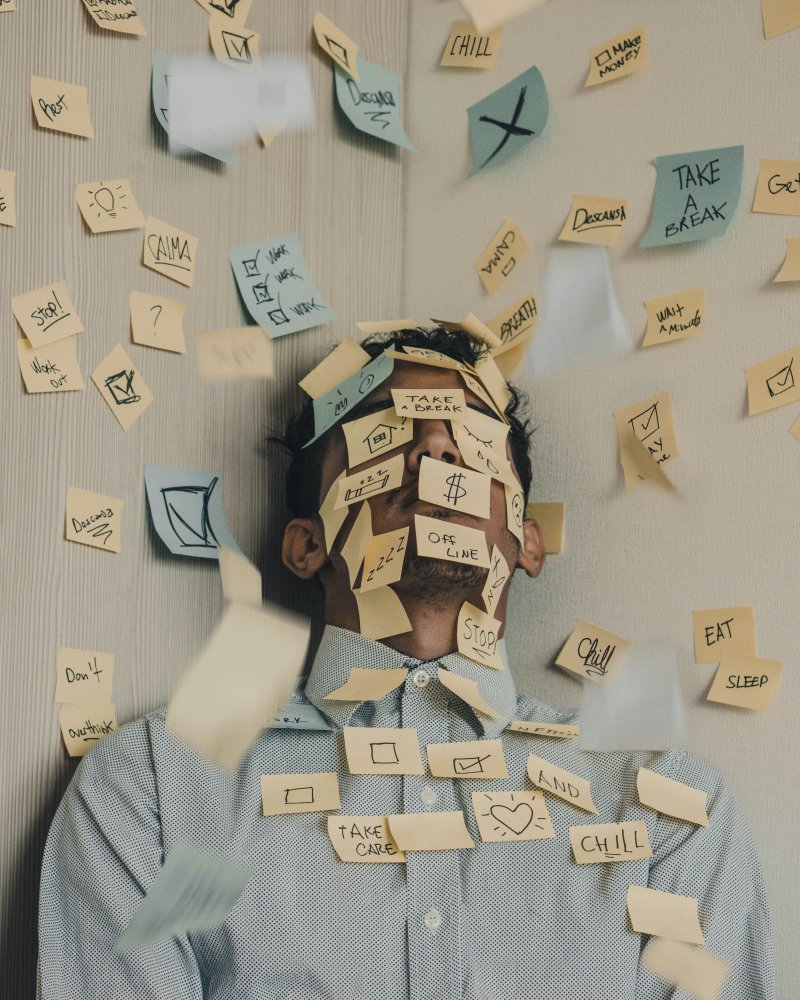

It will cause you stress.

The uncertainty of the time is stressful enough. The joy of being able to help someone in need will be outdone by the stress the moment you start to collect your money and your plead has fallen on deaf ears. You’ve been there. You know the feeling. It was alright back then, you would be going back anyway and you would earn more. As much as you do not want to be on bad terms with your friend or your family, you do not want to jeopardize your chance to make good with what you have saved from the sacrifices you’ve made working away from your family. Anyone who cannot grasp and understand this is not really a friend or family and do not genuinely care about you.

My friend, Yul, a sea-based OFW has recently retired from his lucrative job of commanding a cargo vessel. He lent part of his savings to his entrepreneur friend who is into the construction business even before he decided to hang his uniform. A year after his retirement, with the advent of the pandemic, and businesses going awry (including that of his friend), he decided to go back to his ship. He could have waited for this pandemic to be over sitting comfortably, but his friend has failed to fulfill his side of the agreement. That money was enough for him to get tide over for a couple of years. He said it was stupid of him to lend his money to his friend.

It will derail or stall your plans.

You would always be holding back and counting on the day that you will get your money back. You would not be able to focus on the things that you need to do knowing that somehow your breathing room, your security blanket is compromised.

Because it would always be hard to collect the money back, you would always think of whether or not to pursue your own project now or put it off until you collect the money. You would delay executing the thing that could have yield you profit in the business or even the comfort of the improvement you want to do in your place.

It will make you feel insecure

Not in the sense that your friend or relative is better than you. The uncertainty of whether or not you would be paid or when, makes you feel that you could’ve done better. Remorse, anger, and blaming yourself make you feel inadequate not being able to deal with your friend’s need without compromising your hard-earned money. It puts you in a situation where you now try to plead from your borrower to pay you. The situation turns the other way around. Sad but true. Some borrowers can even become angry when you try to collect persistently.

It will put your relationship to the test.

If your friend doesn’t pay you back in time, it will cause tension. The friendship may turn sour. As lender, you feel that your friend or relative does not value the relationship despite the favor done to the other. You think that you are not in his or her priorities.

What to do instead?

Have an honest conversation with the would-be borrower about your situation. Lay down your plans, if you have to, to make this person understand the situation you are in.

Gently refuse the loan.

See if there is another way you can help the person without resorting to borrowing money.

Believe me, I’ve been there.

Hi, I'm Cecille. I have been an OFW in KSA for 13 long years. I have been there, done that. I'd say I was lucky because for most of those years, my family was with me. I'd like to share in this blog what makes those years worthwhile, the lessons I learned and bits and pieces of info that may pique your interest as bagong bayani.